The purpose of GAAP is to ensure a transparent and consistent method of accounting. GAAP regulates a broad range of accounting concerns, including revenue, expenses, assets, liabilities, financial statement presentation, fair value, foreign currency, leases, business combinations, equity, derivatives and hedging, nonmonetary transactions, industry specific accounting and subsequent events.

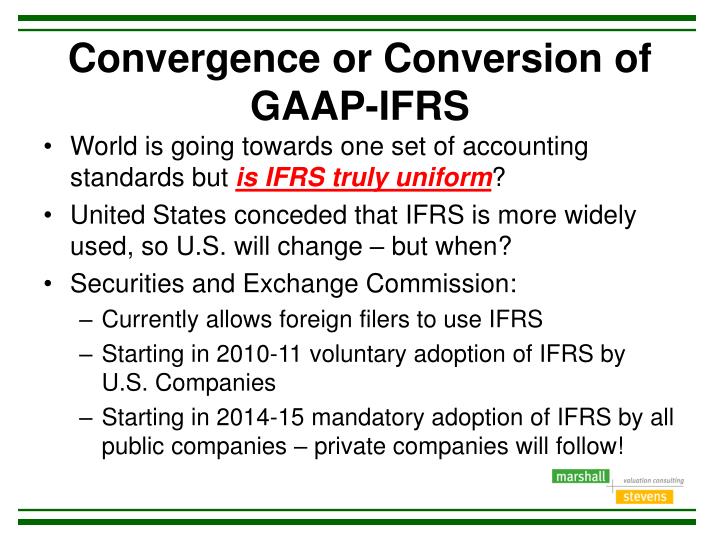

All domestic public companies based in the US must adhere to the US GAAP system of accounting. GAAP, also known as US GAAP, is a set of guidelines regulated by the Financial Accounting Standards Board (FASB) and adopted by the Security and Exchange Commission (SEC) in the USA. The following sections outline how US GAAP and IFRS are similar to each other and how they significantly diverge. Though these two frameworks share many similarities, their differences become apparent when GAAP users attempt to integrate with, report to, or negotiate with IFRS users. Global accounting standards are dominated by two financial reporting frameworks: the International Financial Reporting Standard (IFRS) and the US Generally Accepted Accounting Principles (US GAAP). The main objective of accounting standards is to disclose a company’s financial health to investors, creditors, lenders, contributors, and other key stakeholders, which helps those parties make strategic business decisions and invest in new opportunities. They direct how an organization records finances, show its financial statements, and account for depreciation, amortization, and inventory.

#Ifrs vs gaap fixed writedown reversals professional#

0 kommentar(er)

0 kommentar(er)